Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

$FLUID buy backs coming October 1st.

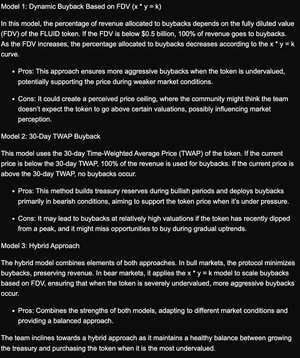

The DAO will vote on 1 of the 3 models:

No 1: Dynamic FDV Curve

100% of revenue to buybacks if FDV < $0.5B

Allocation decreases as FDV rises

- Supports token when undervalued

- Risk of “price ceiling” perception

------------

No 2. Look at the 30-day $FLUID average price (TWAP)

if the token trades below its 30-day average price, revenue is used for buybacks, but if it’s above, no buybacks happen.

It buys weakness, saves cash in strength.

------------

No 3. Hybrid

The hybrid model mixes both: in bull markets, when the token is pumping, buybacks are minimal so more revenue can build the treasury.

But in bear markets, the FDV curve kicks in, allocating more to buybacks when the token looks undervalued.

This way, the DAO avoids wasting cash at the top while still stepping in to support price at the bottom.

---------

Which way should Fluid go?

21,02K

Johtavat

Rankkaus

Suosikit