Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Carlos Domingo

Thanks to John Darsie and @Scaramucci for putting up another great @SALTConference event in the superb Jackson Hole location.

Securitize8 tuntia sitten

“Global markets” without the US aren’t global.

On stage at @SALTConference in Jackson Hole, Securitize CEO @CarlosDomingo affirmed:

"We've always had the vision we have to be regulated and operate out of the US, the largest and most sophisticated capital markets in the world"

1,04K

Carlos Domingo kirjasi uudelleen

“Global markets” without the US aren’t global.

On stage at @SALTConference in Jackson Hole, Securitize CEO @CarlosDomingo affirmed:

"We've always had the vision we have to be regulated and operate out of the US, the largest and most sophisticated capital markets in the world"

2,82K

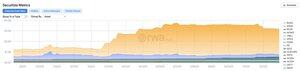

Market is growing and we are continuing to lead it, thanks to the @Securitize team for their work and our customers and partners

Securitize16.8. klo 05.56

Institutional Funds onchain are now a $1B market.

Securitize powers this institutional size, with three of the top fund tokens by AUM driving this growth.

Led by @Mantle_Official's MI4, designed to become the de facto SPX or S&P of crypto, which is now listed on @RWA_xyz.

3,41K

Welcome to the team Graham!!

graham14.8. klo 21.04

1/ Personal Update:

I’m back in the cockpit - joining @Securitize as Head of Ecosystem.

We are working on the only real use case in crypto: TOKENIZATION.

The biggest names in finance are moving size onchain.

And they’re doing it with us.

2,77K

Carlos Domingo kirjasi uudelleen

Real investor protection starts with clear disclosures.

“It may be a security with different characteristics and that’s something that needs to be conveyed to investors.” - @HesterPeirce, SEC Commissioner

When real, regulated assets are tokenized natively, investors get exactly what they own.

4,03K

Carlos Domingo kirjasi uudelleen

We’re excited to welcome @grahamfergs as Securitize’s new Head of Ecosystem.

With deep experience across crypto and TradFi, Graham will lead efforts to expand the world’s largest tokenization platform, bringing more institutions, protocols, and partners onchain with Securitize.

Welcome to the team, Graham!

9,95K

Carlos Domingo kirjasi uudelleen

Yesterday in WSO we covered the top 3 tokenization platforms by onchain value across all of crypto

🚨 Here's what you missed:

4. Tokenization Platforms: The Current Power Players

The tokenization of real-world assets is no longer a fringe sector off in the corner of the crypto industry. It has become one of the most dominant verticals in all of blockchain and shows no signs of slowing down. As TradFi institutions continue pouring in, owning the infrastructure stack to capture that momentum has turned into a high-stakes race. At the front of that race are a handful of tokenization platforms managing billions in tokenized treasuries, equities, bonds, commodities, credit, and funds. Below, we spotlight the largest platforms by total value, as tracked by @RWA_xyz.

The Big 3

Together, these three tokenization platforms control ~53% of onchain market share, each with over $1B in total value.

🥇Securitize — $3.2B TVL | 25.1% Market Share

@Securitize is the current market leader in regulated tokenized assets. It provides the infrastructure behind many of the largest onchain treasury and equity offerings to date, including @BlackRock’s BUIDL fund and tokenized shares for institutions like @apolloglobal, @vaneck_us, @KKR_Co and @hamilton_lane.

The platform supports tokenization across a wide range of asset classes, such as U.S. Treasuries, public and private stocks, institutional funds, and real estate, and is active on more than 10 different Layer-1 blockchains.

Securitize is a registered transfer agent, broker-dealer, ATS, and fund administrator. Its vertically integrated model offers institutions a single, compliant platform for issuance, custody, and trading. By managing the full stack in-house, it reduces counterparty risk and streamlines institutional entry into onchain markets. This positioning has proven effective, as evidenced by the top asset issuers leveraging Securitize to issue their products onchain.

Top 5 Assets

---

🛑 Want to learn about Securitize's Top 5 Assets, along with a full break down of the rest of the Big 3?

👉 Read Wall Street Onchain (08.05.25) now

3,05K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin