Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

WarDaddyCapital

Research Analyst & Strategy @kinetiq_xyz // Building @remintreality // Class of '17 // Cryptopia Maxi // COYS 💙🤍

WarDaddyCapital kirjasi uudelleen

Kinetiq is the fastest-growing protocol on @HyperliquidX, the fastest-growing liquid staking token ever, and the largest liquid holder of $HYPE.

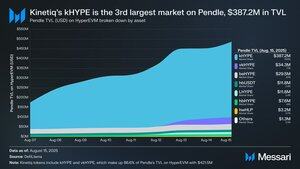

It connects native staking of HYPE on HyperCore with the composability of a burgeoning DeFi ecosystem on HyperEVM. The deployment of @pendle_fi onto HyperEVM has added fuel to the fire.

In just one week, HyperEVM has become the second-largest contributor of Pendle TVL behind Ethereum.

Kinetiq markets on Pendle (kHYPE and vkHYPE) have attracted $421.5 million in TVL as $kHYPE has become the third-largest market on Pendle. In total, 32.2% of kHYPE's supply is deployed on Pendle, making up 86.6% of Pendle's TVL on Hyperliquid.

Kinetiq’s ambition extends beyond liquid staking and institutional adoption. The protocol aims to allow builders to create HIP-3 markets with increased capital efficiency.

While not yet live, HIP-3 markets will allow anyone to create exotic perpetual futures markets atop Hyperliquid. For example, @ventuals_ will allow users to trade pre-IPO companies like @cursor_ai, @cluely, and @krakenfx with up to 10x leverage.

HIP-3 builders will need to acquire and stake one million $HYPE ($48.5M) to deploy. Kinetiq will provide the option to rent stake for a to-be-announced price through Launch, an Exchange-as-a-Service (EaaS) product.

This presents strategic questions for @kinetiq_xyz. Will the price to rent stake be a fixed rate, an algorithmic rate, or a rate related to the success of the underlying HIP-3 market?

Sophisticated HIP-3 deployers may be able to secure stake themselves. This could limit Kinetiq’s ability to attract what will become the highest-performing HIP-3 markets and restrict the attractiveness of a revenue share.

Kinetiq could support 28 HIP-3 builders with over 28.7 million HYPE being staked today.

The success of HIP-3 and its revenue-generating potential remain to be seen. If @kinetiq_xyz opts for a revenue-share model, revenue could be capped if HIP-3 struggles to take off. Changing the protocol’s pricing strategy after setting an initial methodology would prove challenging.

That being said, if the long-term growth and success of Hyperliquid is an assumption, revenue-sharing becomes the optimal option. That assumption is guaranteed to be one held by Kinetiq and its founders, like @0xOmnia, who have proven to be some of the most Hyperliquid-aligned builders in the @HyperliquidX ecosystem.

47,68K

Liquid staked HYPE via @kinetiq_xyz: 28.75mn

Hyperliquid Assistance Fund: 28.71mn

17+% of the circulating supply lies in the hands of these two Hyperliquid-aligned forces

Omnia.hl π14.8. klo 22.56

Today officially marks the 30th day since @kinetiq_xyz launched.

Funnily enough, today is the day the Kinetiq protocol flipped the Assistance Fund to become the largest single concentration of $HYPE.

There is now ~28,000,000 HYPE staked for kHYPE, as well as ~750,000 HYPE staked through iHYPE so far.

This brings the total protocol HYPE TVL to >28.75m vs. the AF’s current (and rapidly growing) holdings of ~28.707m

Racing the AF to hoard more HYPE wasn’t in my relatively immediate bingo card but let it rip, and may Hyperliquid win.

Hyperliquid

3,3K

WarDaddyCapital kirjasi uudelleen

New iHYPE staking partner: @flowdesk_co

Flowdesk joins Kinetiq’s institutional staking network, leveraging iHYPE's fully compliant LST infrastructure. Their clients gain scalable HYPE exposure via private, risk-isolated rails built for regulated entities.

Heavily iHYPE coded.

13,94K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin